Budget Overview 2020

$ 150 K instant asset write off

June 22, 2020

Did you miss out? – JobMaker Hiring Credit

May 24, 2021The budget 2020 is targeted in helping individuals and SMEs. The budget has highlighted altogether 18 tax related reliefs, however some of the measures that are summarized as below:

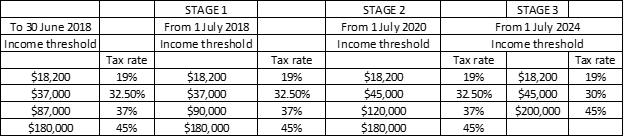

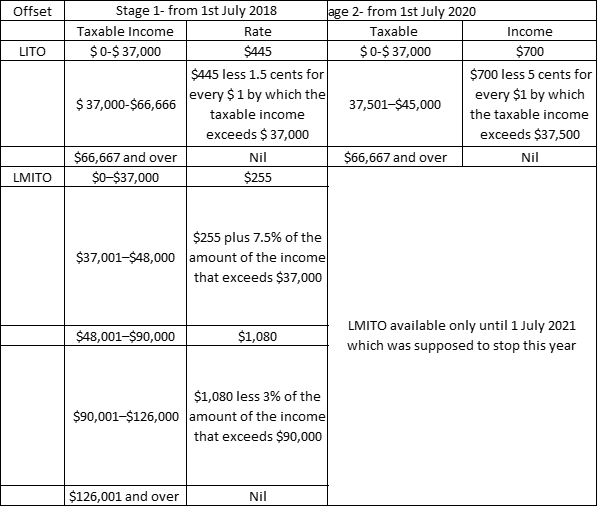

- Individual tax cuts- Stage 2 tax cuts announced earlier has been brought forward from 1 July 2022 to 1 July 2020. The stage 3 tax cuts will be applied on its scheduled FY i.e. 2024.

- The bring forward of the Stage 2 personal tax cuts by two years means people who earn:

- between $45,000 and $90,000 will have an additional $1,080 of post-tax income in 2020–21;

- more than $120,000 will have an additional $2,565 of post-tax income in 2020–21.

- Instant asset write-off: The immediate asset write-off for asset valued up to $ 150K that was scheduled to be switched off on 31 December 2020 has been given a modification. Businesses with turnover exceeding $ 5 billion will be able to instantly write off assets purchased after 7.:30 pm on 6th October 2020 and before 1st July 2022 giving a strong incentive for business to invest in capital upgrades. SMEs with annual aggregated turnover less than $ 50 million will also be able to write off second had assets.

- Loss carry back- This measure temporarily allows businesses with a turnover of $ 5 billion or less to offset any tax losses up to June 2022 to offset against profits from 2019 FY onwards. I.e. the businesses might be able to get a tax refund for the losses they incur in FY 2020, 2021 and 2022 given they have paid tax in FY 2019.

- JOBMAKER: The $4 billion JobMaker Hiring Credit will be payable for up to 12 months for each new job to employers who hire eligible employees (currently on JobSeeker) aged 16-35. The Hiring Credit will be paid quarterly in arrears at the rate of $200 per week for those aged 16-29, and $100 per week for those aged 30-35. Eligible employees are required to work a minimum of 20 hours per week.

- Apprentice wage subsidy scheme – businesses that hire new apprentices will be eligible for a 50% wage subsidy. The $1.2 billion scheme will support 100,000 apprentices and be available to businesses of all sizes.

Manjeet Ghimire Business Advisor Registered Tax Agent ASIC Agent CPA- AU ACMA (UK) Fellow- Tax Institute

A: Level 6, 263 Clarence Street, Sydney, NSW 2000T: 02 4601 1988 | M: 0431 757 016 | F: 02 8212 8046 E: mannie@ebta.com.au